Union level organisations Union Ministries Naypyitaw Council regional or state government state-owned enterprises and municipal organisations to a resident in relation to purchase of goods work performed and supply of services within the country. The malaysian income tax act 1967 ita 1967 provides that where a resident is liable to make payment as listed below other than income of non-resident public entertainers to a non-resident he shall deduct withholding tax at the prescribed rate from such payment and pay that tax to the director general of inland revenue within one month.

Malaysia Sst Sales And Service Tax A Complete Guide

The tax year or year of assessment YA for individual tax runs from 1 January to 31 December calendar year.

. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRB. What is withholding tax. The applicable withholding tax must be remitted to the MIRB within 30 days after paying or crediting the ADDs.

Details of 2 Agent Commission Withholding Tax. Revenue stream in scope. 78 rows Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying or crediting.

Payer refers to an individualbody other than individual carrying on a business in Malaysia. Affected business modelsin-scope activities. Besides LHDN has deferred the remittance of WHT until 31032022.

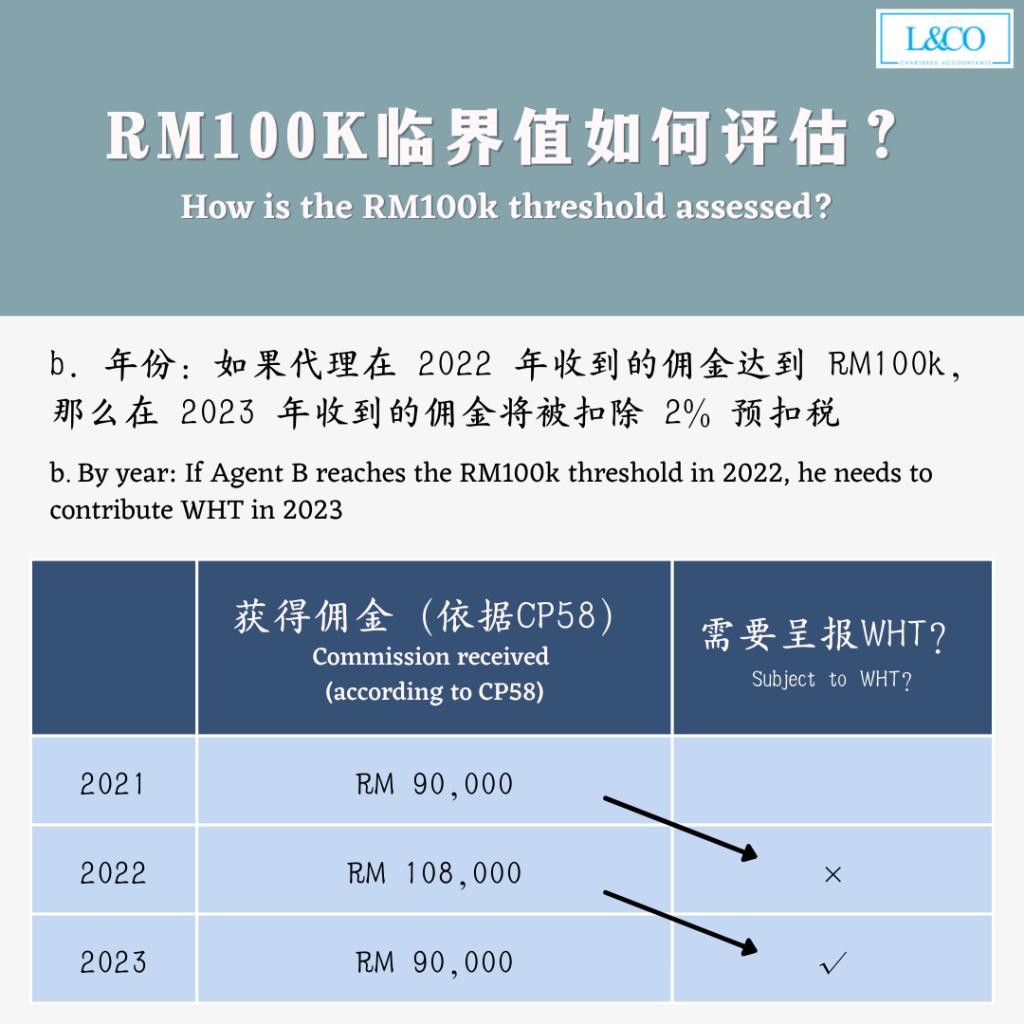

Quoting directly from the Inland Revenue Board of Malaysias official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRBM. A 2 Withholding Tax WHT will be imposed to agents dealers or distributors whose commission exceed RM100k within 1 year. Let us assist you to demystify the changes made to the withholding tax provisions and support you in complying with your withholding.

Under the S109B Income Tax Act 1967 A would need to withhold 10 of that. For example A engages B who is a foreign consultant to give consultation on a project and pays 100000. This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia.

Withholding Tax Withholding tax is an amount of tax that is being withheld by the payer on the income earned by a non-resident payee. The withholding tax under Section 107A is not a final tax. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

This amount has to be paid to LHDN. If a tax resident person is obligated to make certain specified types of payments to a non-resident he or she must deduct withholding tax at a defined rate applicable to the gross payment and send the amount to the Malaysian IRB within one month after making or crediting the payment. Payer refers to an individualbody other than individual carrying on a business in Malaysia.

Malaysia adopts a current year basis of assessment. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the IRB. Person who conducting business in Malaysia.

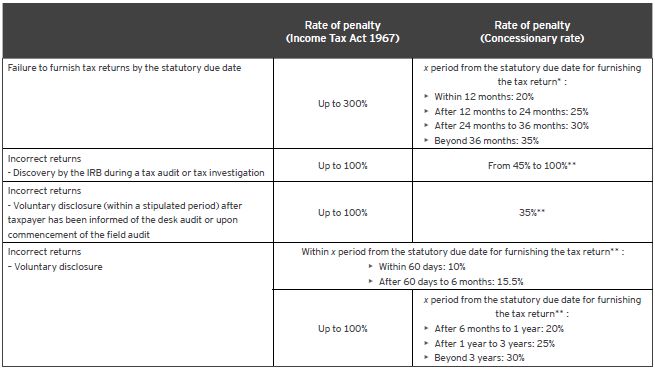

The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. The withholding tax provisions under the Act place tremendous demand on payers and hence a good understanding of the Malaysian withholding tax regime is critical to avoid any potential on non-compliance penalties. Any non-resident company receiving income from the use of or right to use software or the provision of services.

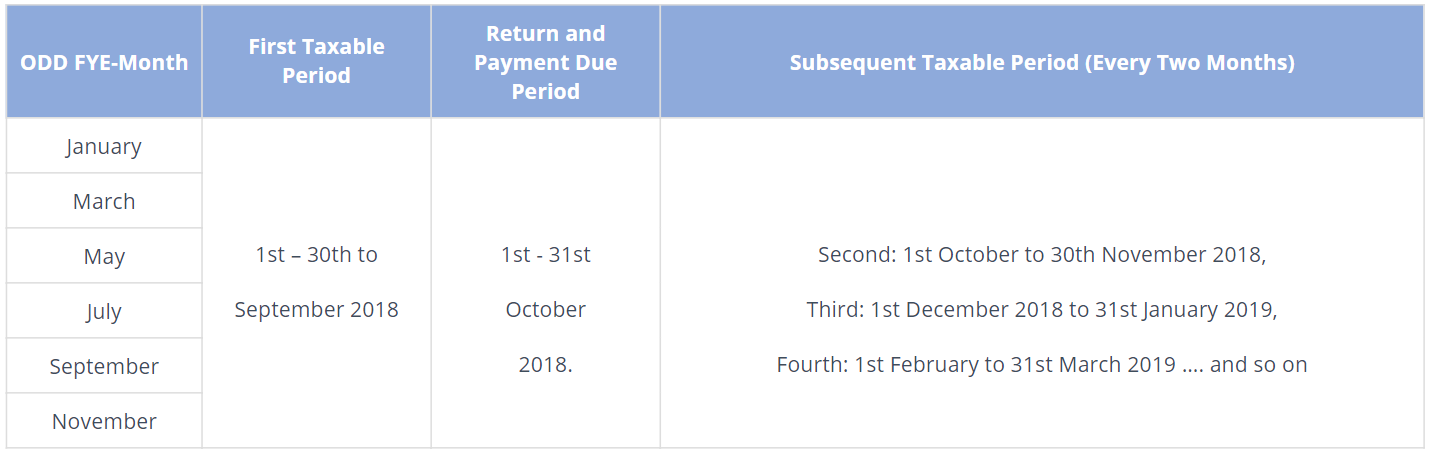

Under the newly introduced WHT provision of Section 107D of the Income Tax Act 1967 effective from 1 January 2022 payments made by companies in monetary form to their authorised ADDs arising from sales transactions or schemes carried out by them are subjected to 2 WHT. This means that income for the calendar year 2019 is taxable in the YA 2019. This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021These proposals will not become law until their enactment and may be.

Income is deemed derived from Malaysia if. This 3 is to account for any tax that may be payable by the employees for services rendered in Malaysia in connection with the contract. The 2 withholding tax will be treated as an advance tax and be deducted in arriving at the balance of tax to be paid upon submission of the income tax return form by the relevant ADDs.

Who is the payee. What is Withholding Tax WHT in Malaysia. In order to be eligible for PWP the expatriates salary must be paid by the overseas company.

Payer refers to an individualbody other than individual carrying on a business in Malaysia. He is required to withhold tax on payments for services renderedtechnical advice. According to the latest FAQ the company has to declare Form CP107D to LHDN and agents must have a tax number.

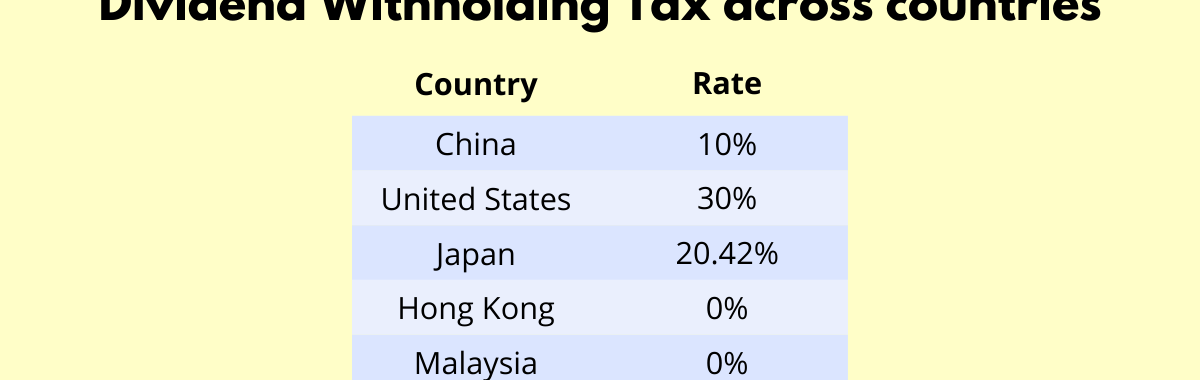

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. Is withholding tax deductible in Malaysia. The general Withholding tax rate on technical fees paid to non-residents in Malaysia is 10 and the corresponding Singapore rate is the prevailing corporate tax rate which is presently 17.

Non-resident employee that received payment of income. He is required to withhold tax on payments for services. The amount of tax is paid to the Inland Revenue Board of Malaysia IRBM.

Treatment of Income from Property. Withholding tax is applicable on payments for certain types of income derived by non-residents. The 2 WHT shall still be applicable on payments made by the government ie.

For taxpayers that have the digital certificates for individual files SG or OG or the digital certificates for company files OeF- file C they can now pay withholding taxes under form CP37A electronically to IRBM via e-WHT. Who is the payer. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

What is withholding tax in Malaysia. The 3 withholding tax will apply regardless of any arrangements that may exist for monthly deductions from the salaries of the relevant employees.

U S Dividend Withholding Tax What Singapore Investors Must Know

Notice Withholding Tax 10 Enagic Malaysia Sdn Bhd

Details Of 2 Agent Commission Withholding Tax L Co

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Payroll And Tax Services In Belgium Payroll Tax Services Financial

Laravel Training In Karachi 3d Educators Information Technology Technology Systems Development

Details Of 2 Agent Commission Withholding Tax L Co

Arena Multimedia Lahore Center 8 Days Adobe Photoshop Professional Course With Raheel Ahmed Baig On 7th Janua Arena Multimedia Network Marketing Solutions

Extended Withholding Tax Sap Simple Docs

Payments That Are Subject To Withholding Tax Wt

Extended Withholding Tax Sap Simple Docs

U S Dividend Withholding Tax What Singapore Investors Must Know

Malaysia Personal Income Tax Guide 2022 Ya 2021

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates